What Is A Mutual Fund And How Does It Work?

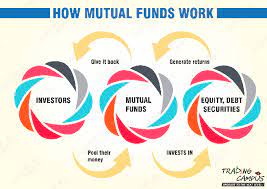

Mutual funds are an investment option that allow people to pool their money together to make larger investments. The goal of a mutual fund is to achieve the highest possible return for its investors, while also minimizing risk. Mutual funds are typically divide into two category: actively manage and passive. Active management means that a fund’s managers make decisions on how to allocate assets among various securities. Passive management means that the fund’s portfolio is automatically balance by a computer algorithm.

Mutual funds can be bought and sold on stock markets like any other security, but they also offer another type of investment call unit investment trusts (UITs). UITs are similar to mutual funds, but they don’t have shareholders who receive dividends or voting rights. They are design for people who want to invest in a specific company or sector without having to worry about the stock market.

Types of Mutual Funds

Mutual funds are one of the most common types of investment vehicles. They allow investors to pool together money from a large number of people to purchase securities, such as stocks or bonds, and then trade them back and forth. The upside to mutual funds is that they provide diversification and exposure Pupula Duplex to a variety of assets. The downside is that there is no guarantee of a return on investment.

There are four main types of mutual funds: open-end mutual funds, closed-end mutual funds, index mutual funds, and commodity pools.

Open-end mutual fund have mutual fund shares that can be bought and sold at any time. Closed-end mutual fund are similar to open-end mutual funds, but the shares can only be sold once the fund has reach its lock-up period.

Types Of Investing In Mutual Funds

Mutual funds are a way to invest in a variety of stocks, bonds, and other securities all at once. In order to invest in a mutual fund msha smart square, you need to buy shares from the fund company. You can do this through your bank, broker, or online.

There are three types of mutual funds:

1) Stock Mutual Funds: These funds invest in stocks and bonds. They are usually split into large-cap and small-cap funds.

2) Bond Mutual Funds: These funds invest in bonds. They are usually split into short-term and long-term funds.

3) International Mutual Funds: These funds invest in stocks, bonds, and other securities around the world.

Pros of Investing In Mutual Funds

Mutual funds are a great way to invest your money. They are regulate by the SEC, so you can be sure that your money is being put into a safe and sound investment. Mutual funds typically offer a higher return than stocks or bonds. This means that over time, mutual funds will usually outperform other investments.

There are many different types of mutual funds to choose from. You can invest in stocks, bonds, balanced funds, and many more. You can also create your own mutual fund by buying shares in an existing fund. There is no need to worry about fees or commissions. Mutual funds usually have low fees and commissions, which makes them a great option for investors.

Overall, mutual funds are a great way to invest your money. They offer high returns over time, and they are easy to access and manage.

Cons of Investing In Mutual Funds

Mutual funds are one of the popular ways to invest money. They are also one of the most controversial. Mutual funds are trusts that pool money from many people and invest it in a variety of stocks, bonds, and other securities. The goal of mutual funds is to achieve a return on investment (ROI) that is higher than the average return achieved by the stocks, bonds, or other securities they own.

There are several things to consider before investing in a mutual fund. First, you need to consider your investment goals. Second, you need to understand how a mutual fund works. Third, you need to evaluate the fees associated with mutual funds. Fourth, you need to know what kind of information you can find about a mutual fund online. Finally, you need to ask questions about a mutual fund before investing.

Can You Get Rich From a Mutual Fund?

Mutual funds are investment vehicles that allow people to invest in a variety of securities, including stocks, bonds, and mutual funds. Mutual funds are typically associate with higher returns than individual investments, but they also come with risks. Before investing in a mutual fund, be sure to do your research and understand the risks involved.

To learn more about mutual funds, read our guide to Mutual Funds: What You Need To Know.