What is a hashReit and the complexity of cryptocurrency mining?

The difficulty of mining is the blockchain network parameter showing how difficult it is to make a mathematical calculation to find a new block and, accordingly, get a reward for this.

Why was the complexity parameter introduced?

Bitcoin mining, like many other cryptocurrencies, is profitable as long as the cost of mined coins exceeds the cost of equipment and electricity. The complexity indicator is of greater importance for the cryptocurrency production process, since it determines how many equipment and what power must be used in the process. In fact, the complexity helps miners to determine the most energy -efficient devices that provide the best profitability. Also, through the complexity of mining, the rate of emissions of new coins is controlled.

How the difficulty of mining is changing?

In the Bitcoin network, recalculation of complexity occurs every 2016 blocks and depends on the time that was required to find the previous 2016 blocks. If the block is every 10 minutes, as Satoshi Nakamoto originally planned to maintain a planned issue of 21 million coins, the presence of 2016 blocks will take two weeks.

If the previous 2016 blocks were found faster – the complexity will be increased, if longer, the complexity will be reduced. The more (or less) time it was spent on finding the previous 2016 blocks, the more the complexity decreases (or increases).

Which affects the complexity of mining?

The complexity indicator depends on the hashrate of the network and the time spent on finding previous blocks.

If the hashReit has grown, it means that new participants joined the cryptocurrency mining. They connected their equipment to the network, so the computing capacity of the network increased. Therefore, the blocking of the block will take less time than with a lower hash.

It follows that:

- The higher the hashrate, the more miners are busy in the extraction of coins, the less time they need to find blocks – the complexity increases;

- The lower the hash, the less miners, the more time it is spent on prey – the complexity is reduced.

What is a hashReit?

The hashReit refers to the total computing capacity of mining equipment involved in the process of cryptocurrency extraction.

The hashrate is expressed in the following units:

Hash/second (h/s);

Kilohesh/s (kh/s);

Meghesh/s (mh/s);

Gighachesh/S (GH/S);

Terahesh/S (Th/S);

Petahsesh/S (PH/S);

Exachash/S (EH/S)

Since mining is constantly becoming more complicated, for example, to see the units “hash per second” in modern blockchain networks is almost impossible. Today, to solve such problems, devices with increased power are needed, starting from dozens of meghesh per second.

For example, the capacity of the processor in 10 mh/s means that in one second it is able to generate 10 million different combinations of numbers to search for the one that will correspond to the entire network parameters.

What depends on the hashReite?

The hashrate depends on a number of key parameters, including the selected cryptocurrency production algorithm. For example, some devices give out maximum indicators inside networks with the SHA algorithm (Bitcoin, Namecoin, Peercoin, etc.), but their effectiveness will be significantly lower in the network using the Scrypt algorithm (Litecoin, Dogecoin, Gridcoin, etc.

Also the specifications of equipment that vary depending on the manufacturer are important. Those who plan to engage in mining are recommended to study information about the power of a device to help in choosing the most optimal and economically profitable option.

Do not forget the popularity of cryptocurrency itself: the more popular it is, the more miners are interested in its prey. They connect their computing power to the network, thereby increasing its hashrate and, accordingly, the difficulty of mining.

How and where you can calculate the profit from mining?

Special mining calculators can come to the rescue: knowing the hash of your equipment, you can calculate the potential profit for a certain period. However, given the dynamism of the hash, such calculations cannot be considered absolutely accurate. For this reason, it is recommended to take data from several sources and calculate the average value.

For example, you can contact the corresponding resources on Cryptocompare sites (data on several cryptocurrencies are available, including BTC, ETH, ZEC, XMR, LTC and DASH) or Nicehash.

How the calculation of complexity is carried out?

The following formula is used to calculate the complexity of mining:

Difficulty = Difficulty_1_Target / Current_Target

where Difficulty is difficulty, and Target is a 256-bit number.

Difficulty_1_target can Bitget will raffle take various values. Usually this is a hash, the first bits of which are 0, the rest is the numbers and letters (this is also called PDIFF or POLOL Difficulty).

This formula may be difficult to understand, therefore, to control the complexity, you can use special resources on which the corresponding graphs are presented, including Bitcoinwisdom, Coinwarz (multiple selection), Blockchain.Com, Bitcoincity, Etherscan (for ETH).

It is recommended to evaluate the complexity of mining simultaneously from several sources, since the indicator is dynamic and this value may change over time.

How complexity affects mining yield?

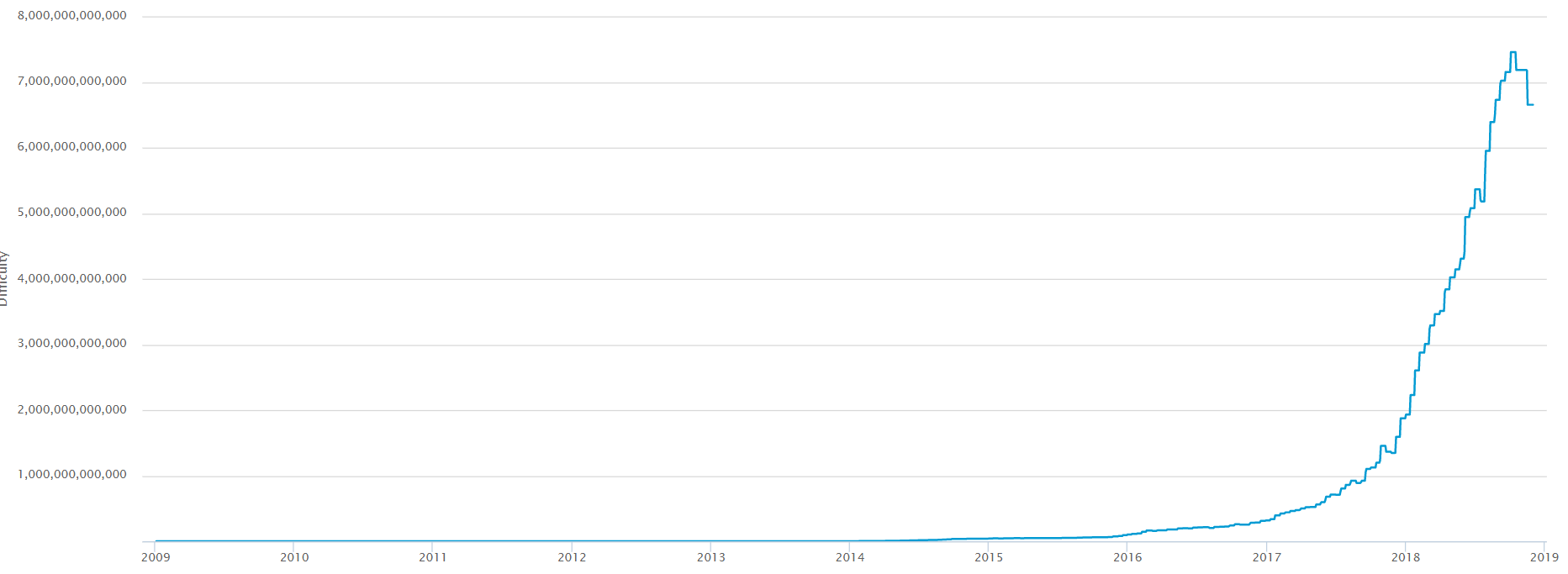

The schedule below shows that in 2017 a sharp increase in the complexity of Bitcoin mining has begun. He stopped only in November 2018, when there was a sharp collapse of the market. At the same time, a decrease in hashrate was also observed.

A similar picture is observed in other most liquid cryptocurrencies. At the same time, until recently, experts estimated the average monthly increase in the complexity of leading altcoins in the amount of 8%. Since then, the situation has changed somewhat, but if you rely on these numbers, then with 8 percent growth of complexity within one month, the profitability of mining capacities will come almost to the zero value after 9 months.

Regarding the breakdown point for the production of bitcoin, at the end of 2018, some analysts stated that at the current difficulty level, the first cryptocurrency should cost at least $ 7,000 (when mining on S9 Antminer devices from Bitmain).

Thus, in conditions when the price of bitcoin dropped to $ 4000, users remain either to purchase even more expensive equipment, or switch to cryptocurrency mining with lower complexity indicators. The first decision may be too expensive, the second is quite risky. The so -called “golden mean”, that is, mining cryptocurrencies with an average level of complexity, can be the best option. Many, however, prefer to completely turn off the equipment, hoping to wait out the period of the market fall, or find alternative options for its use.