Tax brackets can be confusing, especially when you have a lot of information to work with. In this article, we’ll break down the average tax brackets married filing jointly.

What is a Tax Bracket?

The average tax bracket for a married couple filing jointly is typically around 37%. This means that the couple will owe a lower percentage of their income in taxes than if they filed separately. There are several factors that can affect your tax bracket, including your income, marital status, and filing status.

The Difference Between an Individual and Joint Filing

Generally, when you file your taxes as a married couple, you are considered to be filing jointly. This means that your income and deductions are combined, and the tax rates that apply to each of you are applied together. If one spouse earns more money than the other, they may end up owing more in taxes than they would if they filed separately.

One important difference between filing jointly and separately is estate tax. When you file jointly, any estate valued at over $5 million (or $10 million if left to a spouse who is not a U.S. citizen) is taxable at the highest earner’s rate. If you file separately, only the first $2 million of an estate’s value is taxed.

Another difference between filing jointly and separately is how credits are applied. For example, if one spouse gets a credit for child care expenses, that credit will be counted even if the other spouse didn’t actually pay for those expenses. File separately and only one credit will be awarded for those expenses – even if both spouses paid for them! nationaltaxreports.com

Married Filing Jointly vs Married Filing Separately

If you are married, filing jointly is the best way to reduce your taxes. Joint filing allows you and your spouse to combine your incomes and deductions on your tax return, which can reduce your tax bill by as much as 50%. If one of you earns more money than the other, filing separately may result in a higher taxable income.

When filing jointly, each spouse is responsible for his or her own taxes. This means that if one spouse doesn’t file their taxes correctly, they could end up owing money back from the IRS. Fileting jointly also allows you to take advantage of marital credits and deductions, such as the earned income credit (EIC) and the various types of deductions available to couples.

Some couples choose to file separately because one spouse may earn more money than the other or because one spouse does not have any income sources outside of work. If you choose to file separately, make sure that you discuss all of your tax obligations with your partner so that both of you can be sure that you are taking full advantage of all the benefits available to married couples filing jointly.

The Income Threshold

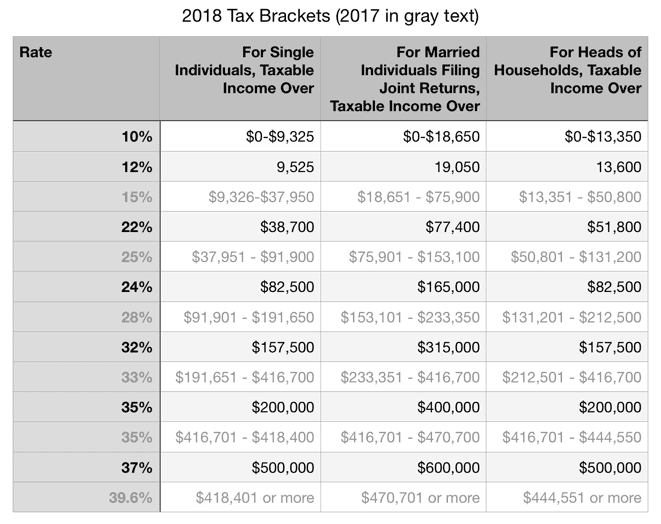

If you are married, you can file jointly and your income will be combined to determine your tax bracket. If you are filing separately, each of your incomes will be considered when determining your tax bracket. The table below shows the average tax bracket for a married couple filing jointly:

Income Tax Bracket $0 – $18,000 10% $18,001 – $37,000 12% $37,001 – $91,900 22% $91,901 – $191,100 24% over $191,100 25%

Tax Brackets for the Different Income Levels

If you are married and filing jointly, your tax bracket is likely to be higher than if you are single. Here are the tax brackets for different income levels as of 2019:

Income Level Tax Rate Single $0-$9,275 10% $9,276-$37,950 15% $37,951-$91,350 25% $91,351-$195,000 28% $195,001-416,700 33% $416,701-466,950 35% Over $466,951 37.5%

Although the tax bracket changes slightly from year to year based on inflation rates and other factors,[1] these are a good starting point for estimating what your individual tax rate might be. If you have other income (such as from investments or side hustles), remember to add that into the equation to get an accurate total tax bill.

Conclusion

If you are married and filing jointly, your average tax bracket is likely to be higher than if you were filing separately. This is because the income of a married couple is combined before taxes are calculated, which means that each spouse pays taxes on their share of the joint income. Keep in mind, though, that not all couples file jointly. If you and your partner have separate incomes or if one of you has earned more money than the other during the year, then filing separately might be a better option for both of you.